Higher education has reached unprecedented costs. The cumulative tuition, rent, books, and food expenses can be daunting. However, the astonishing fact is that millions in scholarships remain unclaimed each year. This article delineates explicit, practical techniques to assist you in reducing your expenditures, minimizing borrowing, and gaining control over your finances.

Understand All College Costs

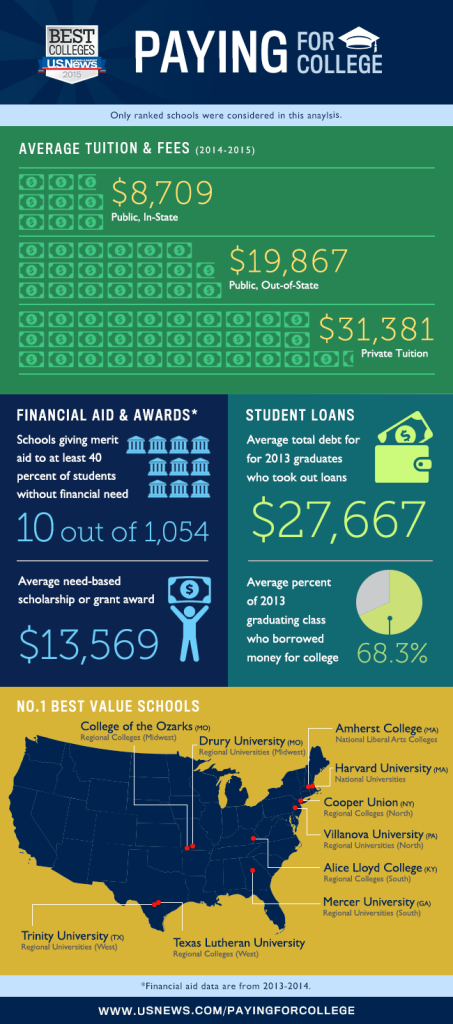

College expenses go well beyond tuition. On average, a public in-state four-year student spends about $27,146 per year, and a private‑nonprofit school can top $58,628, including room, meals, fees, books, transportation, and personal expenses. Here’s a snapshot:

| Expense Category | Approximate Annual Cost |

| Tuition & Fees | $9,750 – $38,421 |

| Room & Board | $10,800 – $14,650 |

| Books & Supplies | $1,200 – $1,420 |

| Transportation | $1,150 – $2,000 |

| Personal & Misc. | $1,200 – $3,410 |

Check the Net Price Calculator on each college’s website to determine what you’ll pay. Equally important is understanding your Student Aid Index (SAI), the figure colleges use to calculate how much aid you’re eligible for. You’ll get it after submitting the FAFSA.

Understanding how colleges calculate your costs and what your family is expected to contribute can raise bigger questions, especially if you’re also trying to grasp the economics behind it all. Concepts like supply and demand, opportunity cost, or the long-term impact of debt aren’t always easy to work through alone.

That’s where tools designed with AI to solve economic problems come in. Whether you need an AI homework helper to walk through a cost-benefit analysis or an AI solver to break down formulas step by step, these online study aids can help make sense of the numbers, both in theory and in practice.

Maximize Financial Aid & Scholarships

If you want to cut down on college costs, the FAFSA is your first step. Submitting it as soon as it opens, on October 1, can make a real difference. It’s how you access federal aid like Pell Grants, subsidized loans, and work-study. Since many funds are limited, early filers often get better packages than those who wait.

Pell Grants, for instance, can give you up to $7,395 per year, and you don’t have to repay a cent. Subsidized federal loans also help by pausing interest while you’re in school. Some colleges go further. Places like Princeton, Amherst, and Williams have no-loan policies that replace all student loans with grants if your family qualifies based on need.

While you’re applying for aid, keep a habit of tracking deadlines and offers, one of the most overlooked personal finance tips among students. Getting organized with your money now can prevent last-minute borrowing later.

Finally, apply for scholarships year-round. Tools like Fastweb, Cappex, and Peterson’s help you uncover awards that can cover tuition, books, or even housing, with no repayment required.

Save Smart with 529 Plans & Tax Credits

Are you concerned about managing the long-term cost of college? A 529 plan is one of the most innovative tools available. It works like a retirement account, but for education. You invest post-tax dollars, and the money grows tax-free.

Many states even offer tax deductions or credits for 529 contributions. Here’s why:

- Tax-free growth

- No tax on qualified withdrawals

- State-level tax benefits

- No income limits to open one

What’s new? Thanks to the SECURE Act 2.0, you can now roll over unused funds into a Roth IRA, up to $35,000 total, with annual caps, if your 529 has been active for 15+ years. That adds flexibility if plans or majors change.

Be careful, though. Don’t pour everything into college savings if you haven’t secured your retirement path. Saving for college matters, but so does your future. And please note tax credits.

| Tax Credit | Max Annual Benefit | Who Can Use It |

| American Opportunity | Up to $2,500 | First 4 years of undergrad |

| Lifetime Learning | Up to $2,000 | Any year, including grad school |

Create and Stick to a Student Budget

Most students underestimate how quickly money disappears. Rent, groceries, streaming subscriptions – it adds up. Begin by mapping two simple lists:

Income

- Part-time job

- Financial aid refunds

- Help from family

- Scholarships or grants

Expenses

- Rent or dorm fees

- Books and supplies

- Meals and snacks

- Transport and gas

- Phone and internet

- Fun money

Now compare. Are you overspending? If yes, cut non-essentials first. Maybe it’s dining out three times a week or impulse buys on apps. Those are areas where you can save quickly.

One of the most underrated tools for staying in control is automation. Set up automatic transfers into a mini savings bucket – spring break, textbooks, emergencies. Even $15 per week makes a difference over time.

Valuable tools for students include:

- Mint (budget tracking)

- CashCourse (college-focused finance)

- Google Sheets or Excel (custom tracking)

Also, pick the right bank. Student accounts should have no monthly fees, no overdraft penalties, and ATM access near campus.

Finally, protect your future. Before dipping into loans, build a basic emergency fund ($500 is a great start). It cushions you from minor crises and keeps debt where it belongs: last resort. Being aware of the real college costs, beyond tuition, helps you make smarter choices every day.

Cut College Costs

You don’t have to pay full price for everything in college, because you can shave thousands off your yearly expenses with the right choices. Start with textbooks. The price of new books keeps climbing, but that doesn’t mean you should pay sticker price. Here’s what to do:

- Check your campus library before buying.

- Rent textbooks (online or at your bookstore).

- Buy used from upperclassmen or sites like Chegg.

- Look for free PDFs or open-source versions when professors allow.

Housing is another significant cost. Room and board can run over $10,000 a year. Here’s how the different options compare:

| Housing Option | Estimated Annual Savings | Key Consideration |

| Living with parents | $8,000+ | Save big, but factor in commute |

| Shared apartment | $2,500–$4,000 | More freedom, split rent & utilities |

| On-campus dorm | – | Convenient, but less flexible |

Earn While You Study

Generating income throughout college mainly focuses on acquiring experience and minimizing your loan debt. Work-study constitutes a robust initial step. Qualifying through FAFSA grants you access to flexible campus employment opportunities.

Other great income options:

- Part-time campus jobs: library, dining hall, tech support

- Internships: paid or for credit, ideally in your field

- Freelance gigs: writing, editing, coding, tutoring

- Peer tutoring: earn $15–25/hour helping classmates

Have a hobby? Turn it into a side hustle. Whether you design logos, fix bikes, or edit videos, there’s a way to make extra cash. Many students earn steady money through services like Fiverr, Upwork, or even their own social circles.

Smart Loan Management

Student loans aren’t free money; they’re a tool, and like any tool, they can help or hurt depending on how you use them. Start with this rule: only borrow what you truly need. The average college tuition for public universities now exceeds $10,000 a year for in-state students, and it’s much higher for private schools. Even so, not every dollar of that should come from loans.

Federal loans are the safer choice. They come with better terms and flexible repayment options.

- Subsidized loans don’t accumulate interest while you’re enrolled, which keeps costs lower over time.

- Unsubsidized loans begin accruing interest immediately, so borrow carefully. If you’re already borrowing, there are also ways to shrink your total repayment cost—such as refinancing or making strategic extra payments. For a detailed breakdown, see this guide on how to reduce your total loan cost.”

Boost Financial Literacy and Plan Ahead

Being good with money is a skill you build over time. The earlier you start, the easier it is to stay in control.

Start with trusted tools:

- CashCourse explains how to handle money in college

- NEFE’s “40 Money Management Tips” gives you a strong foundation, from saving to credit

- Mint tracks every dollar you spend, so you always know where your money is going

Strong habits begin with small actions. Learn to separate wants from needs, build a simple budget that reflects your real life, and check it monthly. Those aren’t just financial planning tips, they’re survival skills in college and beyond.

Also, protect your identity. Scams targeting students are everywhere. Never give away personal or banking information unless you’re absolutely sure who you’re dealing with.

Additionally, seek assistance from others. Talk to your parents or someone you trust. They can help you plan for bills, discuss major expenses, or even co-manage a joint account. Use the financial aid office on campus; those counselors can help you understand loans, grants, and emergencies. And if you want real, long-term guidance? Set up a meeting with a certified financial planner (CFP®).

Conclusion & Next Steps

Paying for college is tough, but not impossible. Understand your real costs, apply for aid early, budget purposefully, and borrow only when needed. Stay organized, build good habits, and make wise choices. With a clear plan, you can cut debt and take control of your future.